Tokenization explained

New opportunities for various assets

As digitalization takes on the financial industry, tokenization becomes an integral part of the capital market of tomorrow. Using the blockchain techology, tokenization securitizes of assets – in a digital manner. This opens up vast possibilities for both assets and investors and will shape the future of capital markets all together.

Trusted by

Definition

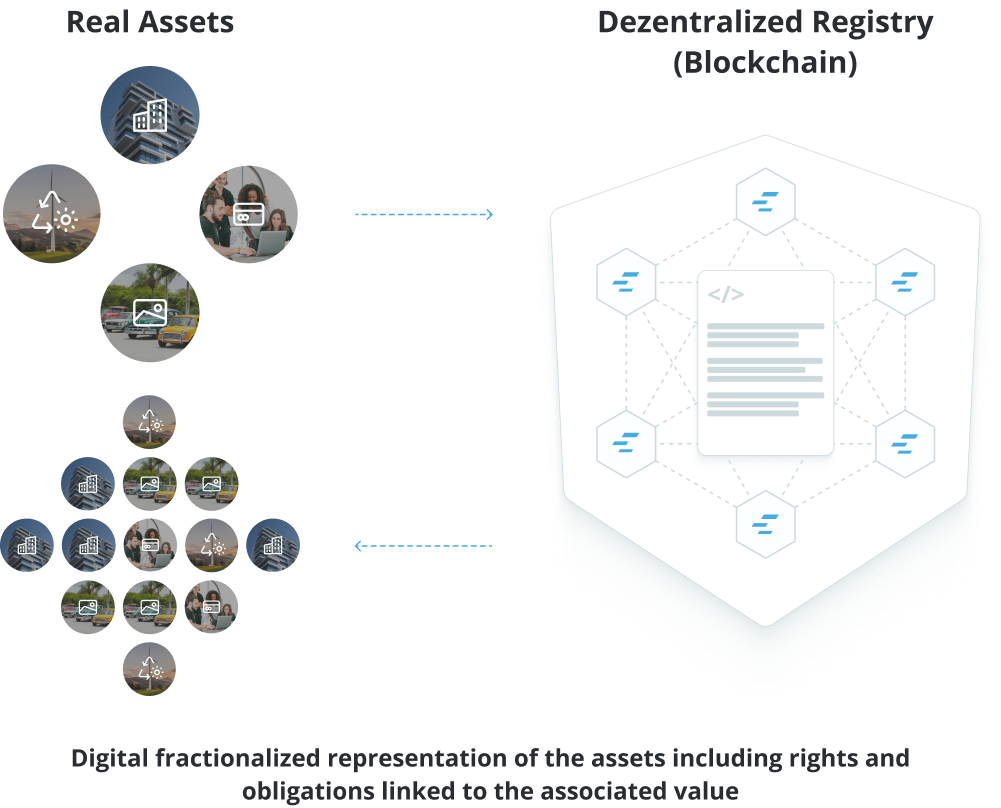

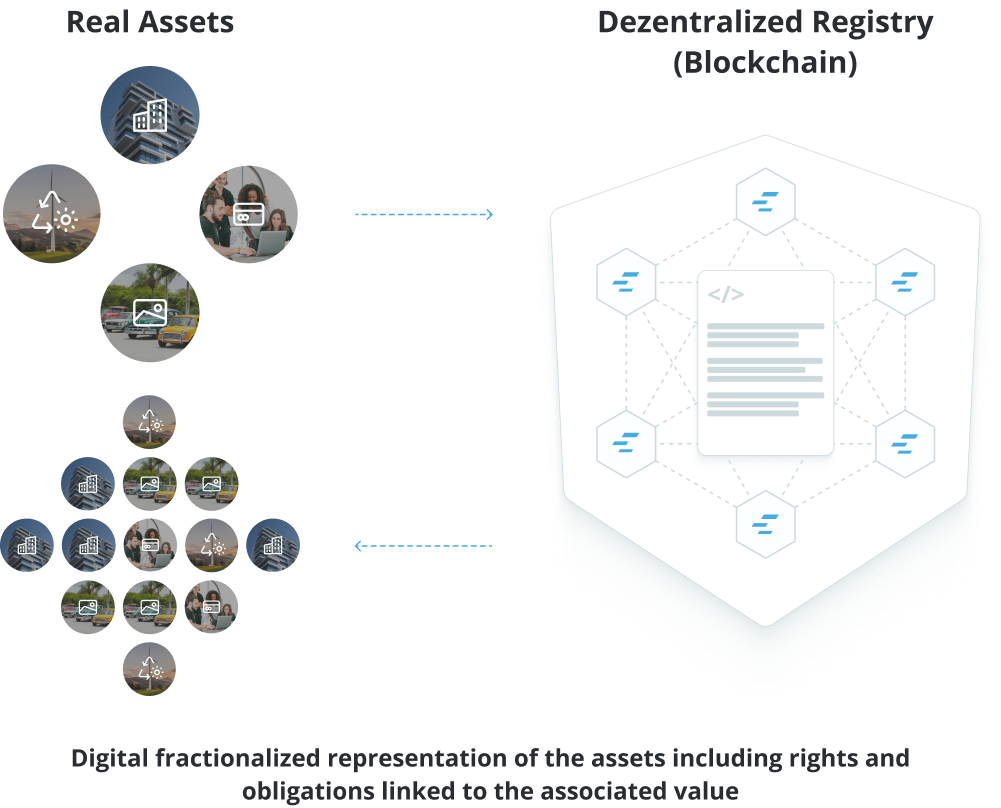

What is tokenization?

Put simply, tokenization is the securitization of assets via blockchain. Real assets are digitally represented using the blockchain technology, including rights and obligations linked to the associated value. To map an asset on the blockchain, so-called security tokens are issued. They represent a certain proportion of the initial value. They can represent regulated financial instruments like equity, bonds or funds, but als tangible assets like real estate. The new Electronic Securities Act (eWpG) also allows so-called crypto securities to be issued.

A digital program, called smart contract, maps the the rights and obligations of the legal contract, and is represents them in a token. The token can be transferred digitally – which means that the underlying assets can be transferred. This opens up vast possibilities for any financial party: investors, issuers and intermediaries like platforms.

New whitepaper: All about asset tokenization

How asset tokenization is revolutionizing the private capital market (in cooperation with inVenture, arttrade, Econos and WIWIN) and how you can also benefit from blockchain technology.

- Expert knowledge

- Case Studies

- Deep-Dive asset tokenization

HOW TO

The 4 steps of asset tokenization

In tokenization, an asset is legally linked to a smart contract. This then represents the rights and obligations associated with the asset like a conventional security. Our all-in-one tokenization solution covers the entire process of a securities issue and can be flexibly integrated into any existing system. Our team of experts will be happy to advise you and guide you through the entire process.

1. Pre-Emission

Prospectus creation and structuring

Regulatory framework

Network of experienced partner law firms

2. Emission

Signing and issuance of assets

Regulatory framework

3. Post-Emission

Custody Management

Asset management

Investor management

4. Trading

Trading

Market-Making

Secondary market

In summary: Tokenization explained the easy way

With the digital transformation of the financial industry, the topic of tokenization has gained enormous importance in recent years. To gain an initial understanding of this topic, we have put together a compact one pager for you here

- Expert knowledge

- One Pager

- Tokenization explained the easy way

FACts

Advantages of Tokenization

Already today, companies, investment banks, asset managers, funds, exchanges and investment platforms are benefiting from the opportunities of tokenization. There are many benefits: faster processes through digitization, fewer intermediaries that reduce costs and increase efficiency, and global portability. Be one of the pioneers in your industry and reap the benefits today!

65% lower costs

compared to traditional securities, as the costs of the value chain are drastically reduced.

24/7 transferability

Previously illiquid assets can now be transferred easily around the clock anywhere in the world.

99% faster processing

faster settlement of processes, as the speed of transactions is significantly increased by the use of tokenized securities.

100% more transparency

because transactions are stored in an unchangeable and transparent manner. This strengthens trust between market participants.

Products

Find the right product package

From your own platform to the integration of crypto securities in a simple way.

Investment Platforms

The flexible solution for your investment platform

Financial Institutions

Support from pilot project to own license application

Asset Manager

Versatile use of your asset portfolio

TOKENIZATION-FAQ

Frequently asked questions

What does tokenization mean and what is a token?

Bafin defines tokenization as “the digital reproduction of an asset or value including the rights and obligations attached to it as well as the transferability this makes possible”. The digital representation is usually implemented on a blockchain. To map an asset on a blockchain, so-called tokens are issued. Each of these tokens represents a certain part of the mapped value. For this purpose, a contract is usually drawn up, which defines which rights and obligations result from a token. The tokens can be transferred completely digital to another party. This also transfers all rights and obligations from the contract. By tokenization, an asset can be transferred completely digitally. If an asset becomes transferable and is largely standardized, the BaFin considers it to be a security in the regulatory sense. The tokenized assets are therefore also called digital securities.

What assets can be tokenized?

In principle, almost any asset can be tokenized. As a rule, the legal situation in the jurisdiction of the issuing party and the structuring of the security is decisive.

Tokenization of corporate investments

In Germany, company investments are currently tokenized predominantly in the form of a profit participation right. Profit participation rights are very flexible and can completely map a company participation economically. A tokenized share or GmbH share is planned by the German government in its block chain strategy, but has not yet been implemented. In other jurisdictions, such as Lichtenstein, company shares can already be completely tokenized.

Tokenization Of Real Estate

Real estate can be tokenized via a so-called SPV (special-purpose vehicle). For this purpose, a company is set up whose purpose is to hold the real estate. The shares of this company are tokenized, making shares in the property transferable. To visualize this, we have created a case-study talking all about this topic. Click here for the case study.

Tokenization of tangible assets

The tokenization of tangible assets, e.g. art, is usually very similar to the tokenization of real estate. For this purpose, the tangible assets are transferred to an SPV (special-purpose vehicle), which is then tokenized.

Tokenization of (existing) securities

Even existing securities, e.g. a share, can be tokenized. By means of a legal structure similar to a tracker certificate, the value of an existing security can be mapped directly.

How does tokenization work?

In tokenization, an asset is legally linked to a digital representation (token) on a blockchain. With our Tokenization-as-a-Service infrastructure, no special blockchain know-how is required. You can either use our web-based Cashlink Studio to tokenize assets. Alternatively, you can connect our Tokenization API to your existing system.Our team will be happy to advise you and guide you through the complete process.

What is the meaning of a token?

A token is used to represent assets on the blockchain. These can be any type of asset, from artwork, real estate, and trees, to traditional financial instruments such as stocks. The process of mapping these real-world assets to a token is called tokenization. In this process, various types of tokens can be created, including securities. Below we explain two different types of tokens, which are regulated tokenized securities in Germany.

What are Security Tokens?

A Security Token (also called a sui generis security) is a token which is defined by BaFin as a security under prospectus law. They are therefore officially regulated securities in tokenized form. It is a crypto-asset which assigns membership rights or debt claims of pecuniary content to the holders. For example, the token represents a digital security for non-alcoholic organic wine, solar park projects, or shares in real estate construction projects. Security tokens therefore serve the same purpose as securities, but are issued digitally rather than in paper form.

And electronic securities?

Since the new electronic securities law was passed in 2021, it has been possible to issue electronic securities. A distinction is made here between central register securities and crytpowert securities. The latter is a subtype of electronic securities, which is characterized by a decentralized register. With the help of blockchain technology, a tokenized security is thus approved for the first time in Germany, which is now defined as a security not only in terms of prospectus law, but also from a civil law perspective.

TOKENIZATION-FAQ

Frequently asked questions

What does tokenization mean and what is a token?

Bafin defines tokenization as “the digital reproduction of an asset or value including the rights and obligations attached to it as well as the transferability this makes possible”. The digital representation is usually implemented on a blockchain. To map an asset on a blockchain, so-called tokens are issued. Each of these tokens represents a certain part of the mapped value. For this purpose, a contract is usually drawn up, which defines which rights and obligations result from a token. The tokens can be transferred completely digital to another party. This also transfers all rights and obligations from the contract. By tokenization, an asset can be transferred completely digitally. If an asset becomes transferable and is largely standardized, the BaFin considers it to be a security in the regulatory sense. The tokenized assets are therefore also called digital securities.

What assets can be tokenized?

In principle, almost any asset can be tokenized. As a rule, the legal situation in the jurisdiction of the issuing party and the structuring of the security is decisive.

Tokenization of corporate investments

In Germany, company investments are currently tokenized predominantly in the form of a profit participation right. Profit participation rights are very flexible and can completely map a company participation economically. A tokenized share or GmbH share is planned by the German government in its block chain strategy, but has not yet been implemented. In other jurisdictions, such as Lichtenstein, company shares can already be completely tokenized.

Tokenization Of Real Estate

Real estate can be tokenized via a so-called SPV (special-purpose vehicle). For this purpose, a company is set up whose purpose is to hold the real estate. The shares of this company are tokenized, making shares in the property transferable. To visualize this, we have created a case-study talking all about this topic. Click here for the case study.

Tokenization of tangible assets

The tokenization of tangible assets, e.g. art, is usually very similar to the tokenization of real estate. For this purpose, the tangible assets are transferred to an SPV (special-purpose vehicle), which is then tokenized.

Tokenization of (existing) securities

Even existing securities, e.g. a share, can be tokenized. By means of a legal structure similar to a tracker certificate, the value of an existing security can be mapped directly.

How does tokenization work?

In tokenization, an asset is legally linked to a digital representation (token) on a blockchain. With our Tokenization-as-a-Service infrastructure, no special blockchain know-how is required. You can either use our web-based Cashlink Studio to tokenize assets. Alternatively, you can connect our Tokenization API to your existing system.Our team will be happy to advise you and guide you through the complete process.

What is the meaning of a token?

A token is used to represent assets on the blockchain. These can be any type of asset, from artwork, real estate, and trees, to traditional financial instruments such as stocks. The process of mapping these real-world assets to a token is called tokenization. In this process, various types of tokens can be created, including securities. Below we explain two different types of tokens, which are regulated tokenized securities in Germany.

What are Security Tokens?

A Security Token (also called a sui generis security) is a token which is defined by BaFin as a security under prospectus law. They are therefore officially regulated securities in tokenized form. It is a crypto-asset which assigns membership rights or debt claims of pecuniary content to the holders. For example, the token represents a digital security for non-alcoholic organic wine, solar park projects, or shares in real estate construction projects. Security tokens therefore serve the same purpose as securities, but are issued digitally rather than in paper form.

And electronic securities?

Since the new electronic securities law was passed in 2021, it has been possible to issue electronic securities. A distinction is made here between central register securities and crytpowert securities. The latter is a subtype of electronic securities, which is characterized by a decentralized register. With the help of blockchain technology, a tokenized security is thus approved for the first time in Germany, which is now defined as a security not only in terms of prospectus law, but also from a civil law perspective.

Talk to our experts

Our team will be pleased to advise you, arrange a non-binding consultation now.