Investment Platforms

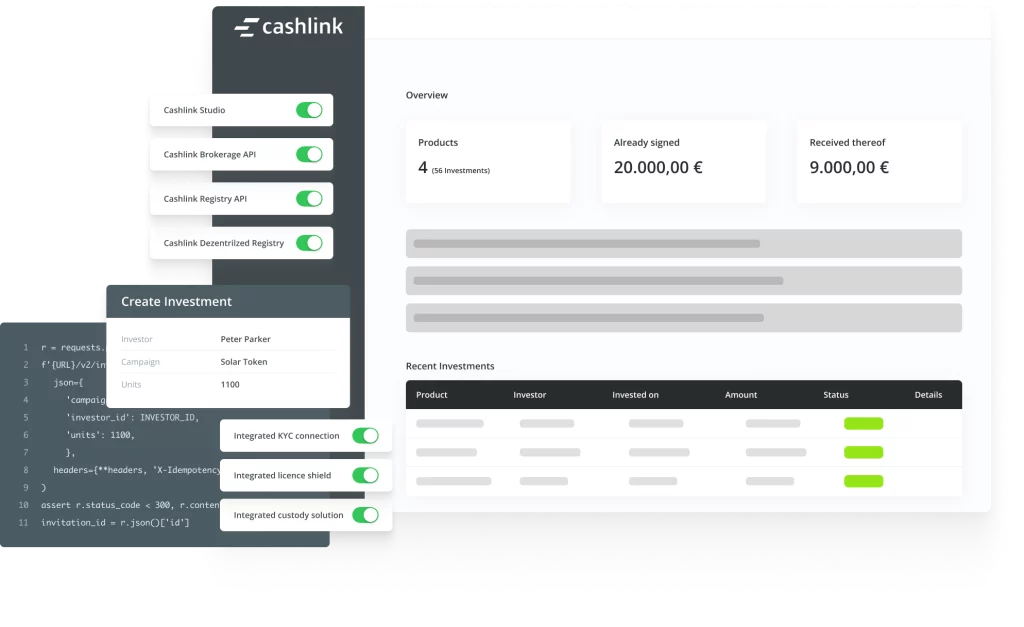

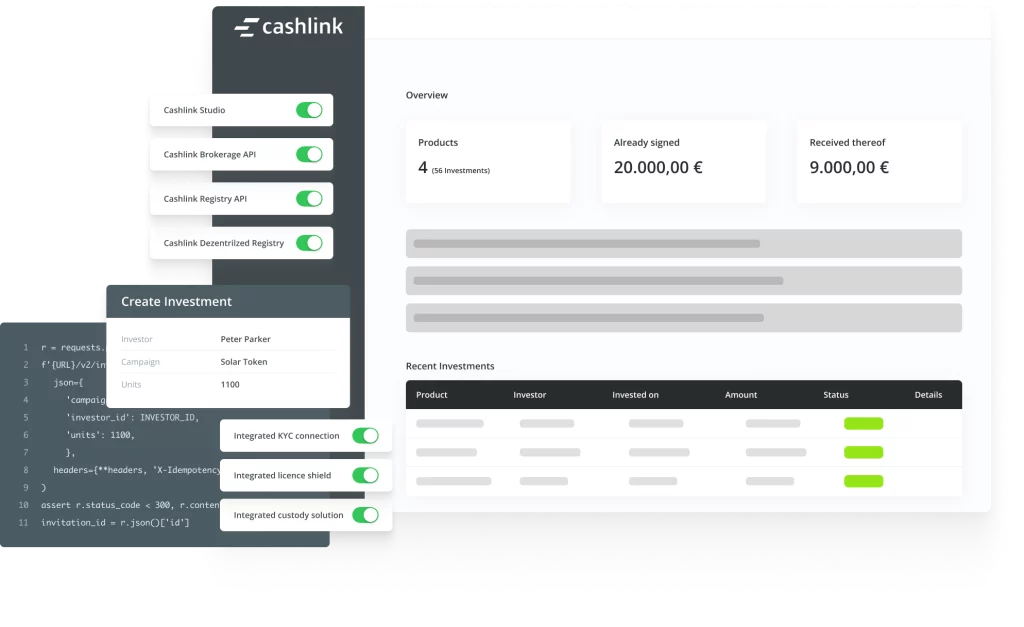

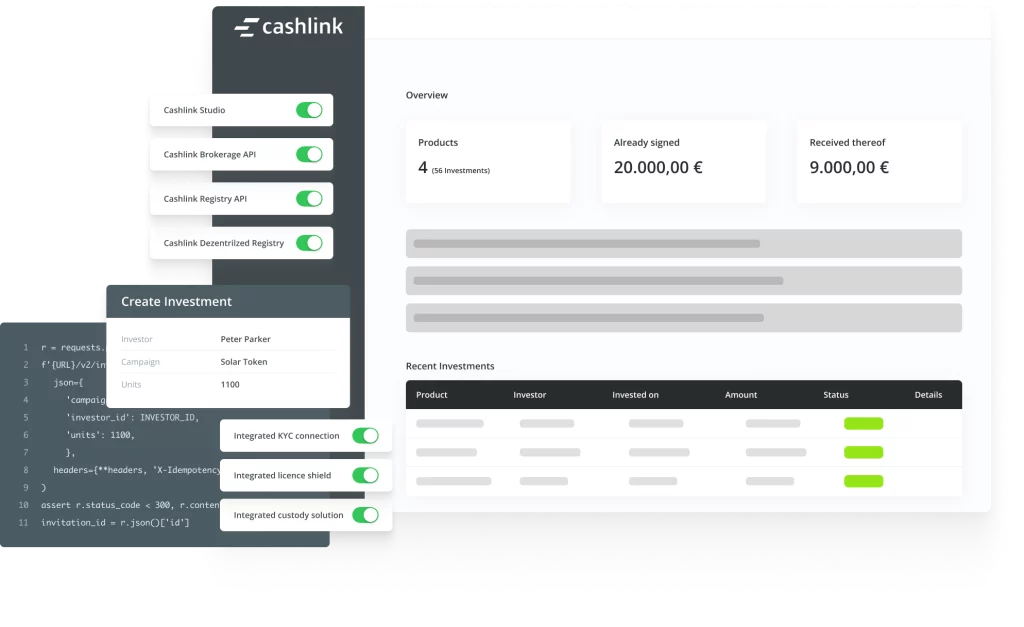

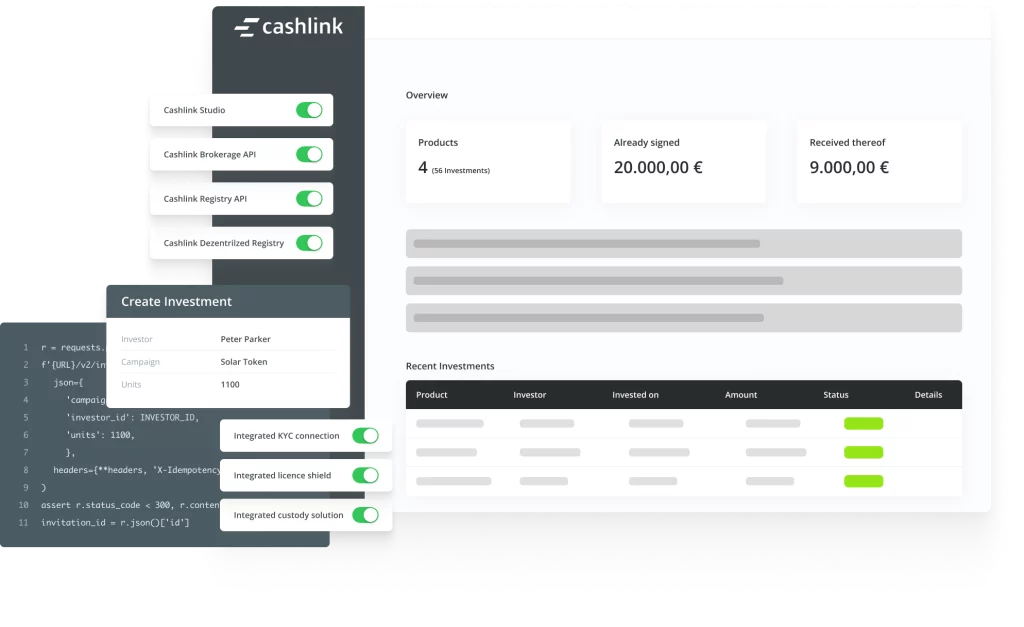

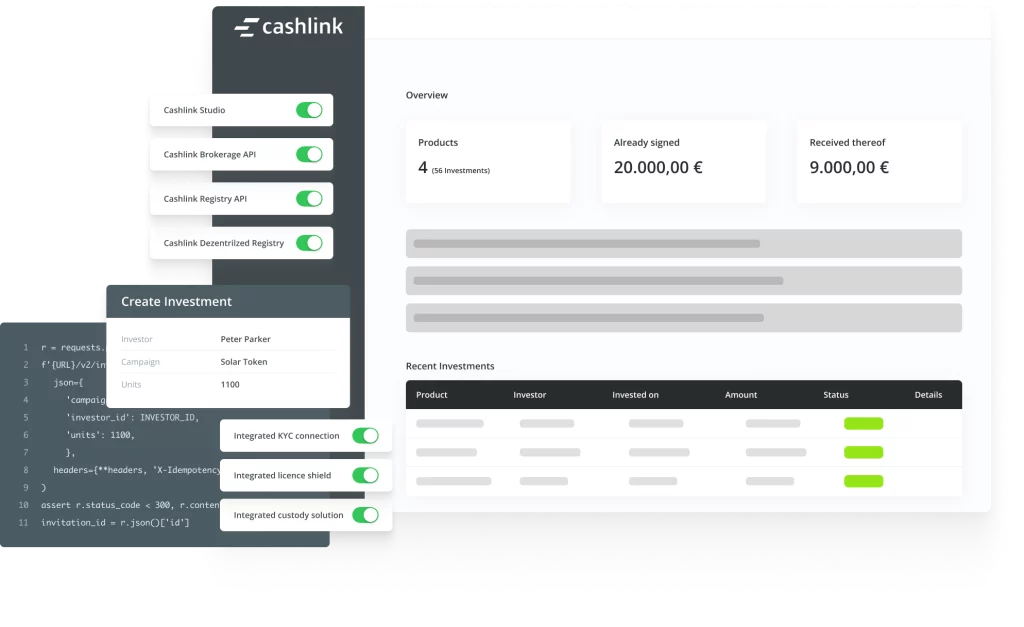

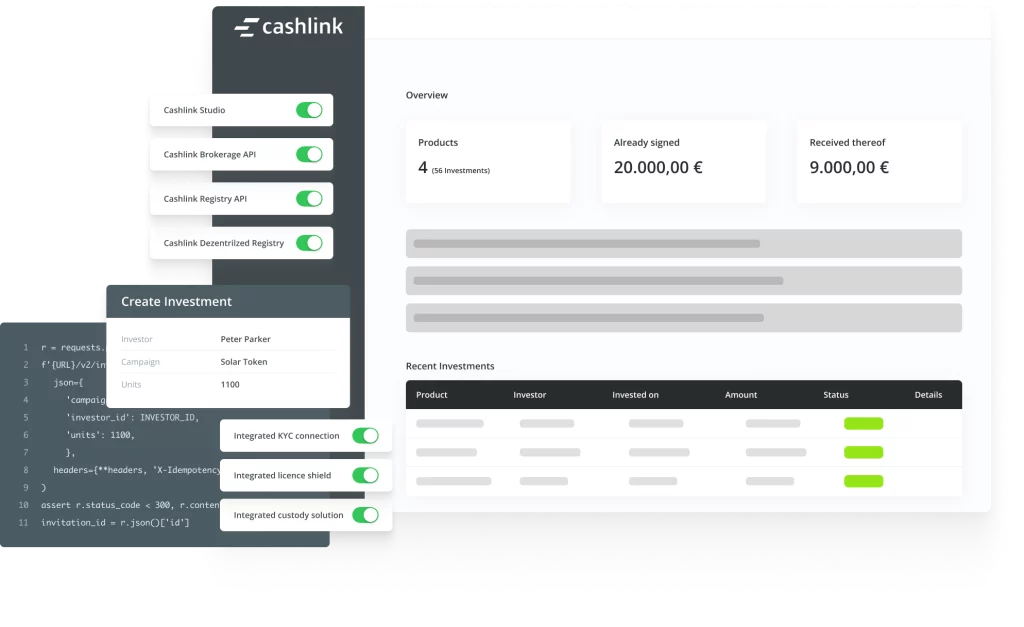

Our product packages for your platform

From building a new investment platform to integrating crypto securities into your existing product - we offer the right product package for you.

Products

Flexibility and speed for your platform

We know the importance of focusing on your core business. Therefore, our product packages cover all technical and regulatory aspects of asset tokenization.

All-in-One Solution | Investment Platform API | Registry-as-a-Service API | |

|---|---|---|---|

| Crypto Securities Registry | |||

| Prebuilt frontends | Your own frontend | Completely flexible infrastructure of your own platform possible. Regardless of whether as a new platform or as an integration into your existing platform. | |

| KYC/AML-Processes | |||

| Custody license | Flexible | ||

| Investment brokerage license | |||

| Market launch | <6 weeks possible | Depending on project | Depending on project |

View product | View product | View product |

Regulatory

Integrated compliance

Our solution covers all regulatory requirements. All necessary licenses for the issuance up to the distribution of crypto securities are fully integrated through us and our partners.

Crypto custody

Our integrated custody partners are exclusively qualified crypto custodians (§64y para. 1 KWG). The private keys of the investors are thus kept in a secure and regulated environment.

Crypto Securities Registry

All product packages comply with the requirements of the Electronic Securities Act. Cashlink has a provisional permit from BaFin for crypto securities registry management (§ 65 Abs. 2 KWG).

Investment brokerage

A liability umbrella in accordance with § 3 (2) WpIG is pre-integrated into our solution, thus enabling the legally compliant distribution of financial instruments.

WHAT WE OFFER

One partner for all processes

Prospecting and structuring

Assistance with structuring

Support in the preparation of the prospectus

Selection of a suitable law firm

Boosting distribution power

Identify suitable distribution partners and increase placement power

Develop sustainable distribution strategy

Custody solutions

Regulated crypto custody

Self-Custody

Lifecycle Management

Projectmanagement

Asset-Servicing

Investor Management

Products

Find the right product package

From your own platform to the integration of crypto securities in a simple way.

All-In-One Solution

The comprehensive solution for your tokenization project

Investment-Platform-API

The most flexible approach to designing your investment platform

Registry-as-a-Service API

The most flexible integration of crypto securities

Talk to our experts

Our team will be happy to advise you, arrange a non-binding consultation now.

Simon Censkowsky

Senior Manager Strategic Business Development

s.censkowsky@cashlink.de

linkedin.com/in/scenskowsky