The holistic regulatory solution

We bring the necessary know-how and licenses, you the innovative business model. Benefit from our carefree & legally compliant solutions.

Licences

Carefree and legally compliant

As an holistic solution the Cashlink solution lifts barriers for market participants and ensures regulatory compliance by providing all required licenses among the value chain of tokenization projects. As we partnered up with experts, you have all necessary licenses in one spot.

Regulatory security

Ensured compliance as regulated institutions take care of compliant processes

Fast time to market

Through efficient set up and proven processes

Focus on the core business

While Cashlink and partners take care of the compliance side

Regulated infrastructure solution - through our crypto securities registry license.

Cashlink has a license pursuant to Section 32 (1) sentence 1 KwG to maintain a crypto securities register in accordance with Section 16 of the German Electronic Securities Act (eWpG). All our product packages include crypto securities issuances according to the new Electronic Securities Act (eWpG). Further integrated licenses are licenses for:

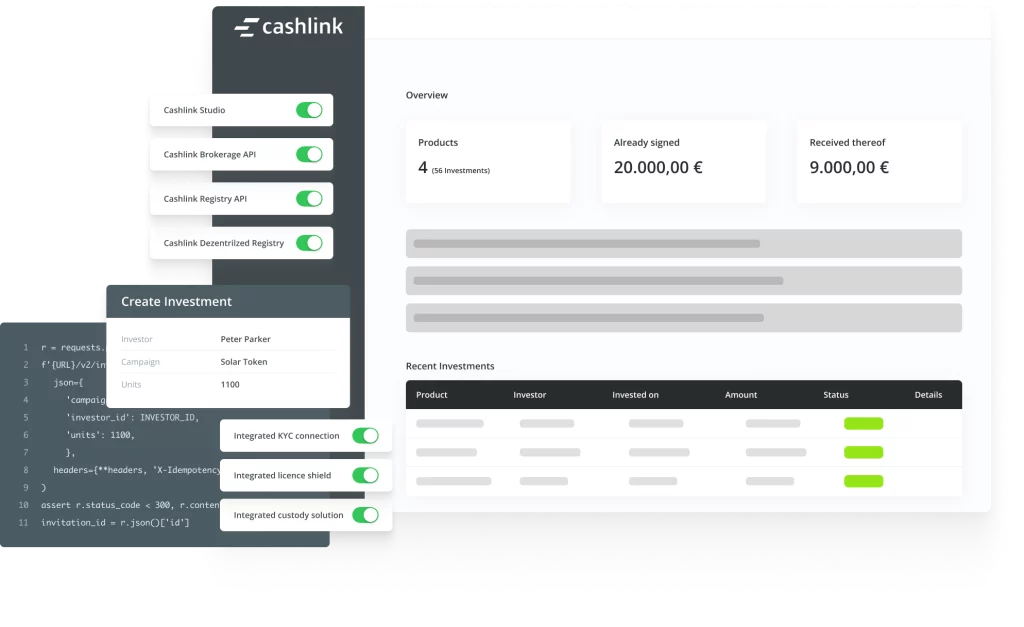

- Investment brokerage license

- Custody license

Integrated licences

Investment brokerage license

For the compliant distribution of financial instruments an investment brokerage license is required. The Cashlink solution offers an integrated investment brokerage license after the German Banking Act (§ 3 (2) WpIG) and thus guarantees compliant distribution of financial instruments.

Integrated licences

Custody license

Safekeeping private keys on behalf of others is a regulated activity in Germany and requires custodians to hold a license. Our integrated custody partners operate as qualified custodians (§64y Para. 1 KWG) and are supervised by the German Federal Financial Supervisory Authority (BaFin). Investors’ funds are stored in a safe and regulated environment and can thus not be lost.

Solutions

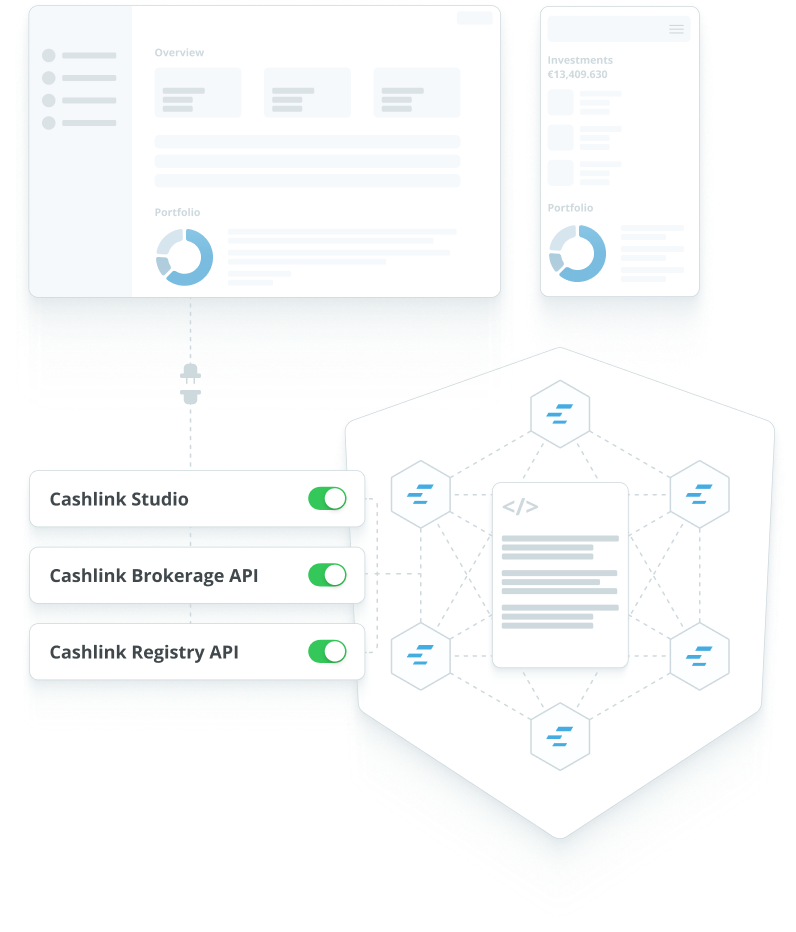

Our solutions for your individual needs

From your own investment platform to the direct integration of our crypto securities infrastructure and the distribution of tokenized securities

Investment Platforms

With Cashlink Connect, we support investment platforms in the issuance and distribution of tokenized assets.

Financial Institutions

Remaining future-proof through digitalization of securities issuance and settlement

Asset Managers

Together with leading custodian banks, Cashlink offers asset managers access to tokenized private market assets.

The infrastructure for your platform

Our team will be more than happy to guide you, arrange a no-obligation consultation now.