Cashlink Connect Core

Token-based Securities on the Fast Track

Get started in the world of token-based securities. With Cashlink Connect Core, we offer issuers to securely issue and manage token-based securities in compliance with the German electronic securities act (eWpG). Benefit from unbeatable cost savings up to 85% along the value chain and gain competitive advantages. Connect directly with leading traditional distribution partners and new target groups such as WEB3 investors.

BENEFITS

Tokenization: Sustainable Benefits with Cashlink

Cost Savings of Up to 80%

Through more efficient processes and the elimination of intermediaries, you can reduce your costs by up to 80%.

Read more in our Pricing Study

Private Market Assets: Invest Starting at €100

Tokenization enables investments starting from as little as €100.

Access to Web3 Distribution Channels

Combine Web2 and Web3 distribution channels to secure sustainable competitive advantages and gain access to exclusive Web3 investors.

Fully Regulated

The Electronic Securities Act (eWpG) provides you with a clear legal framework for the issuance and management of tokenized securities.

The choice of Financial institutions

The core of our leading infrastructure for token-based securities assets at a glance

With Cashlink Connect Core, we offer a market-proven and scalable infrastructure for the issuance of token-based securities in compliance with the eWpG. Benefit from an institutional grade infrastructure with the highest degree of connections to traditional orderflow providers and custodian banks as well as Web3 brokers:

- Market-leading: Our solution is battle-tested and proven, having already processed over 40.000 transactions

- Direct market access: Connection to numerous distribution partners and secondary market places that have integrated the Cashlink infrastructure to stream and trade token-based securities.

- Highest security standards: Our in-house built smart contract suite has been audited multiple times, ensuring top-tier security.

- Real-time on-chain Delivery-vs-Payment: Our solution is interoperable with ECB Trigger solutions and leading stablecoins.

- DORA-ready: We maintain banking-grade processes in accordance with DORA, leading to a high level of compliance.

- Seamless integration: Our infrastructure can be directly integrated into existing, traditional banking infrastructure and core banking systems.

- Multi-Blockchain Smart Contract Suite: You have a choice of several public permissioned infrastructures, with private permissioned and additional ledgers available upon request.

- API-first: Our platform's robust infrastructure, developed in line with the latest industry standards, enables the scalable growth of flexible use cases.

Cashlink Issuances

Issue- and manage token-based securities at scale.

- API-first creation of issuances, manual processes possible on request

- eWpG-compliant (eWpG, eWpRV, KryptoFAV)

- Real-time settlement via European Central Bank Trigger-Solution (T+0)

- Compatible with major trading venues, especially OTC and DLT-TSS / DLT-MTF marketplaces

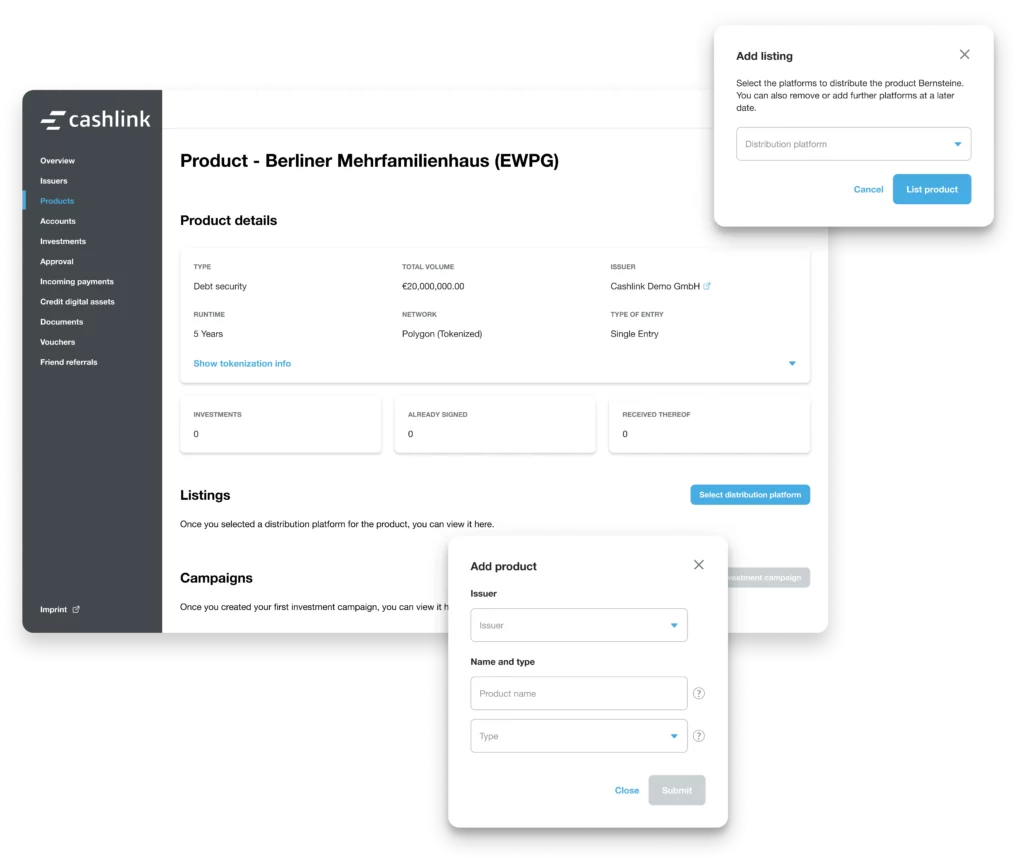

Cashlink Studio

Manage the entire issuance process and token-based securities lifecycle.

- Overview of all registry entries of the respective issuances

- Monitor Cashlink Connect activity

- Reporting and data provision

- Paying and tax agent services for capital gains for single entry, including KEST withholding

Cashlink Decentralized Registry

Ownership of token-based securities is managed securely and transparently on the blockchain.

- Token Smart Contract Suite

- Real-time settlement with stablecoins (t+0)

- ERC-20-compatibility of the token-based securities and the Token Smart Contract Suite

- Currently supported underlying networks: Ethereum, Polygon, Stellar

Cashlink Connect Core Features

Our Technical Infrastructure

API first

The platform’s robust, API-first infrastructure—developed in line with the latest industry standards—enables smooth integration, rapid implementation, and scalable growth. It offers the flexibility and efficiency required to support banking grade scalable usecases.

Audited Smart Contract Suite

Cashlink has built an audited token factory that efficiently maps all required lifecycle- and compliance features for token-based securities and is compliant with the German Electronic Securities Act (eWpG)

Interoperability

Cashlinks token standard, and thus token-based securities, are compatible and ready for integration with other market participants.

On-Chain Compliance

Cashlinks technical infrastructure automatically enforces compliance on-chain (e.g. whitelisting) to comply with securities regulations.

"Cashlink's unique infrastructure is a substantial building block that enables our 'Tokenization as a Service.' In particular, the holistic infrastructure solution, combining technology and regulation, is a perfect fit for our full-service offering around the tokenization of assets."

Investmentplattformen

Betreiben Sie eine Investmentplattform?

Cashlink unterstützt Investmentplattformen bei der Emission und Distribution alternativer und Private Market Assets. Erfahren Sie mehr zu Cashlinks modularem Serviceangebot und warum Sie mit uns zusammenarbeiten sollten.

PRODUCTS

Go Beyond Issuance: With Cashlink Connect Distribution Hub, you can also successfully distribute assets.

Cashlink Connect Distribution Hub

More Power for Your Distribution – Ideal for anyone looking to distribute their products through their own platform.

Get started with token-based securities now.

Use Cashlink Connect Core to issue and manage crypto securities quickly, securely, and cost-effectively. Tap into new target groups such as crypto investors, reduce your costs, and connect directly with leading distribution partners.

Get started now and benefit from a future-proof solution for your crypto securities.