Financial institutions

Gain competitive edge through digitization of the securities issuance- and settlement

Cashlink offers the leading banking grade tokenization infrastructure.

Tokenization

Tokenization and DLT is changing Capital Markets

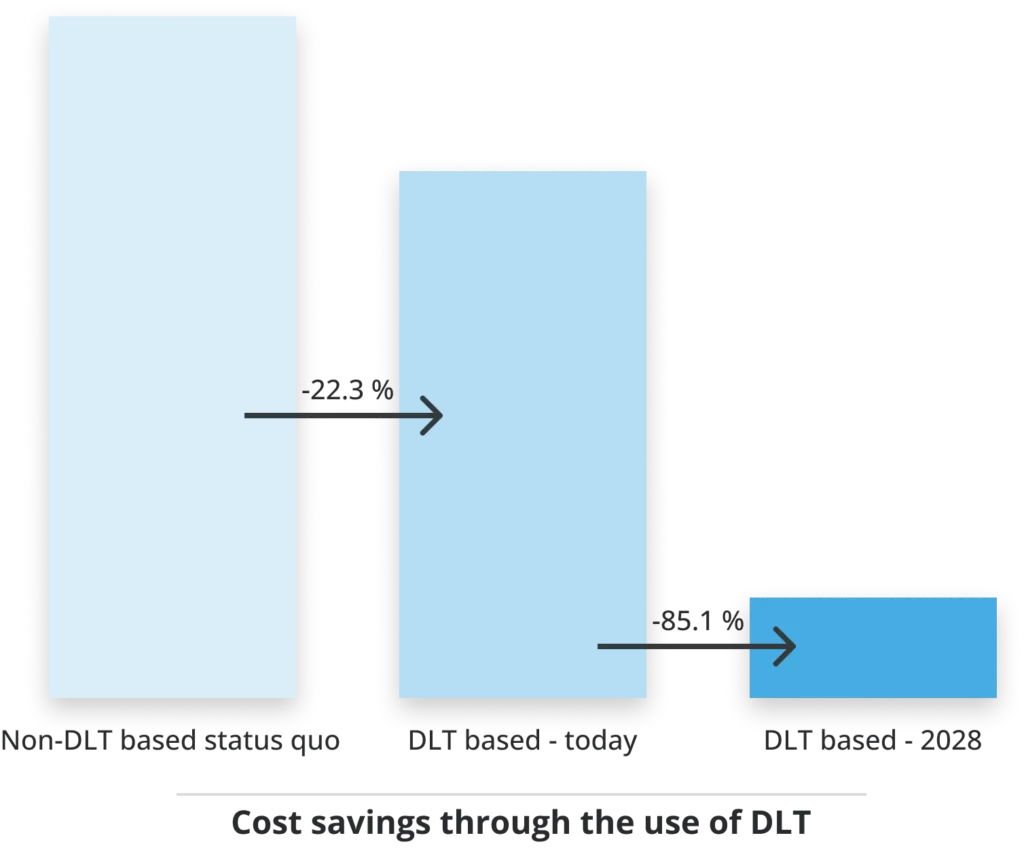

By using DLT and tokenization technology cost savings up to 85% can be realized through process efficiencies and the elimination of intermediaries over the lifecycle of financial instruments. Find out more about the cost savings from the use of DLT in the capital market in our study.

BENEFITS

Competitive advantages for financial institutions

Tokenization fundamentally changes the way securities are processed and offers many competitive advantages

Digital & smart financial instruments

Smart contracts make financial instruments programmable and can map business logic.

Value chains reinvented

Thanks to DLT and smart contracts, intermediaries in the value chain can be eliminated.

Compatible with digital money

Whether stablecoin, digital euro or deposit tokens. Settle transactions in real time using atomic swaps.

Automate corporate actions

Smart contracts automate corporate actions over the life cycle of the financial instrument.

Services

Cashlink offers the regulated tokenization infrastructure

Banking grade infrastructure

BAIT & MaRisk compliant solution with the highest IT security standards.

Neutrality

As a neutral infrastructure provider, we are never in competition with our customers.

API first

Easy integration with banking systems of investment banks, brokers, stock exchanges or custodian banks.

Fast and flexible go-to-market

Agile and modular infrastructure supports individual customer requirements.

Use Cases

Cashlink's infrastructure supports a variety of use cases

- Real World Assets

- UCITS funds

- Structured products

- Bonds

- ELTIF

- ...and many more

Crypto securities

The electronic Securities Act creates the regulatory foundation for corresponding use cases

Financial instruments that can be issued in accordance with eWpG

Bearer bonds

- Bonds

- Warrants

- Convertible bonds

- Participation rights

Structured products

- Certificates

- Warrants

- Structured bonds

- Digital twins

Fund units

- Possible for UCITs that are classified as "special assets"

Shares

- Registered shares

Fund units

- Possible for UCITs that are classified as "special assets"

Shares

- Registered shares

Partner Use Cases

Use cases with our banking partners

Talk to our experts

Our team will be happy to advise you, arrange a non-binding consultation now.

Simon Censkowsky

Senior Manager Strategic Business Development

s.censkowsky@cashlink.de

linkedin.com/in/scenskowsky