Investment platforms

The leading infrastructure for tokenized assets

Cashlink supports investment platforms in the issuance and distribution of alternative and private market assets.

Service

Our modular service offering for investment platforms

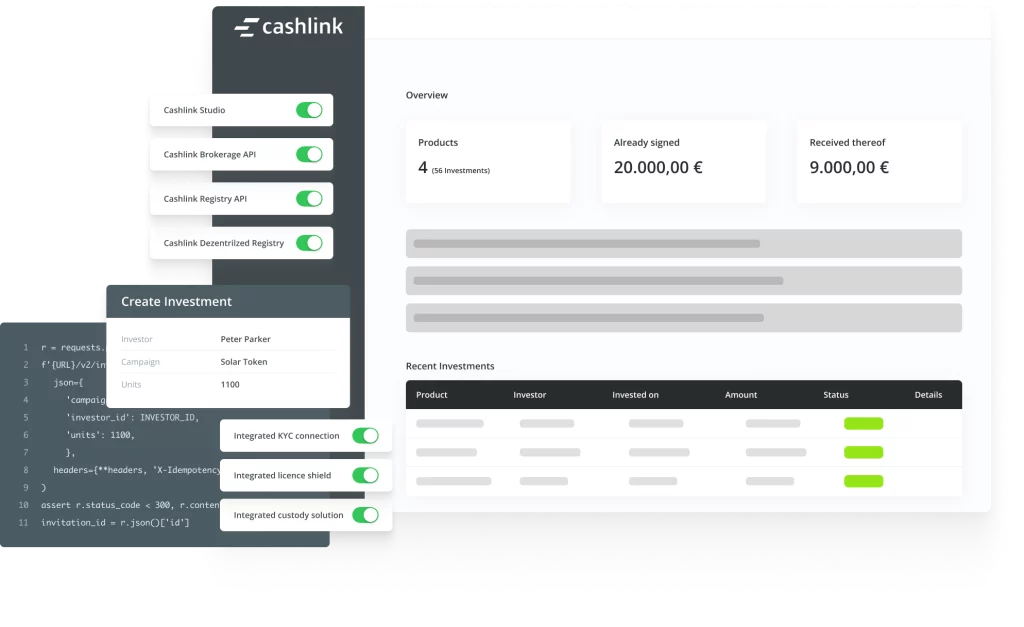

All our solutions are available as API or whitelabel solutions

Tokenization

Cashlink’s tokenization solution abstracts the complexity of smart contracts and blockchain technology and covers all the technical and regulatory functions required in an API or no-code solution.

Crypto securities register

All product packages comply with the requirements of the Electronic Securities Act. Cashlink has a license pursuant to Section 32 (1) sentence 1 KwG to maintain a crypto securities register pursuant to Section 16 of the eWpG.

Liability umbrella

Part of our solution is a liability umbrella partner in accordance with Section 3 (2) WpIG as standard. This enables the legally compliant distribution of financial instruments.

Crypto custody

Our integrated custody partners are exclusively qualified crypto custodians (Section 64y (1) KWG). This means that investors can be provided with a regulated wallet solution for secure custody.

Our service offering adapts flexibly to your needs thanks to its modular structure and can be purchased as an API or white label solution.

Benefits

The advantages for investment platforms

Access to alternative assets

Making alternative asset classes accessible and distributable through tokenization.

Regulatory compliant

Regulatory compliant tokenization of assets through Cashlink as a crypto securities register.

Increased sales power

Cashlink Connect links the issuer and distribution side.

Cashlink Connect - The leading distribution solution for tokenized assets

Our robust and easily accessible infrastructure connects the distribution and asset side. Fully regulated and technically secure, we support the growth of our partner companies. Read our free one pager for more information.

"With Cashlink Connect, Cashlink is now taking the next pioneering step in the area of tokenized assets. With our investment platform for curated art, we are participating in the partner program and have already been able to benefit from the strong sales power of the distribution partners."

"Cashlink Connect plays a crucial role in realizing WIWIN's vision of promoting the sustainability transition and making impact investing accessible to the masses. Through Cashlink's standardized and regulated securities infrastructure, wealth managers, family offices and other distribution partners can be seamlessly connected to our platform."

Cashlink Connect

Cashlink provides the leading infrastructure for the private asset market

Cashlink Connect links the asset issuer with strong distribution partners from our network via our neutral infrastructure. In this way, we utilize strong network effects that open up new opportunities for both the asset and the distribution side.

- eWpG-compliant tokenization infrastructure

- Access to distribution partners for issuers

- Asset pool for distribution partners

- Comprehensive lifecycle management for tokenized securities

Talk to our experts

Our team will be happy to advise you, arrange a non-binding consultation now.

Simon Censkowsky

Senior Manager Strategic Business Development

s.censkowsky@cashlink.de

linkedin.com/in/scenskowsky