Our solutions for your project

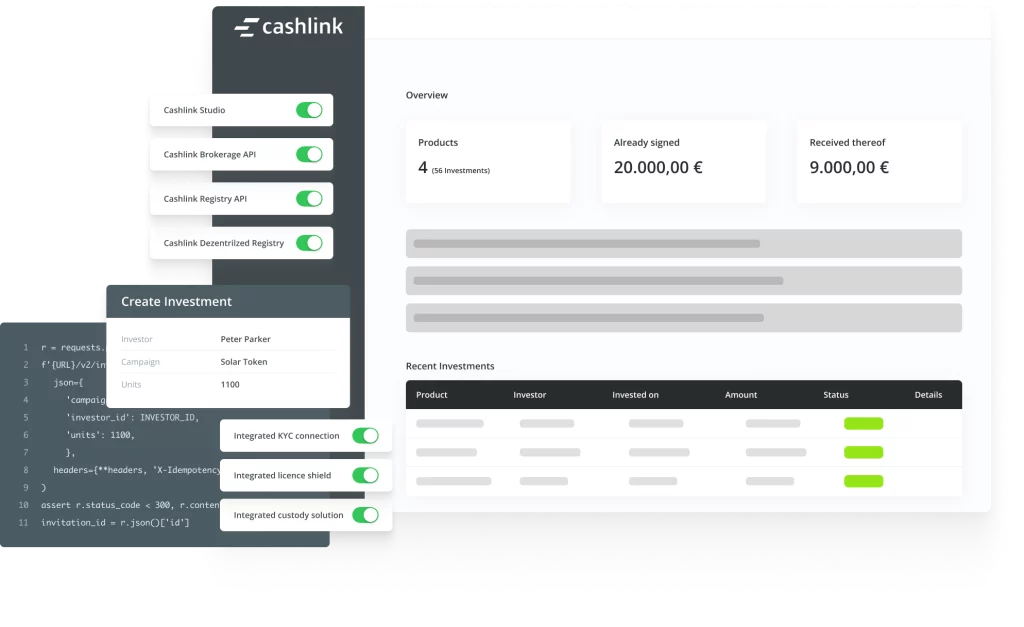

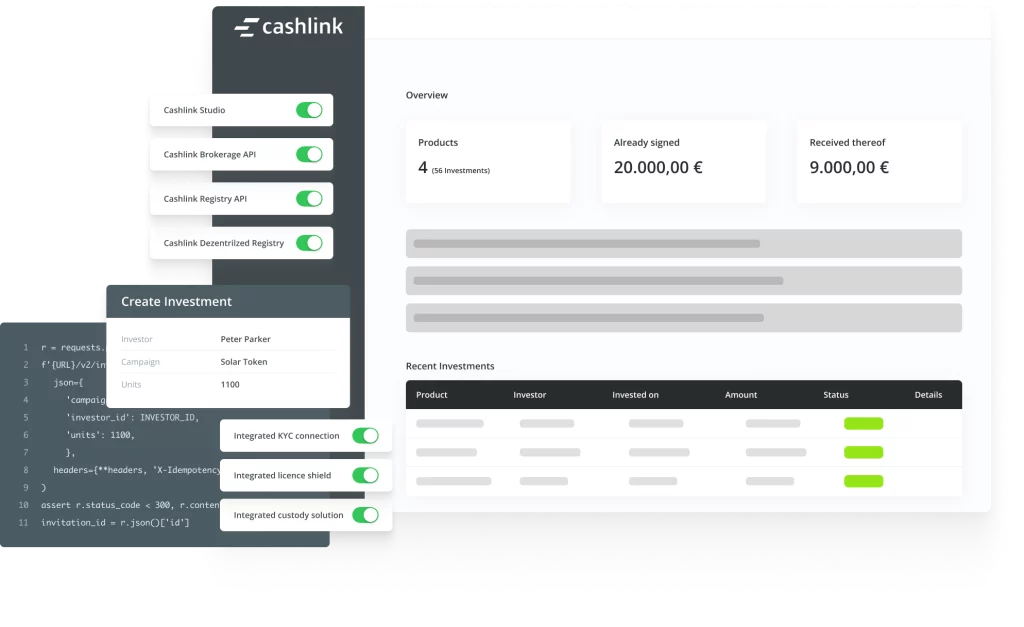

Issue and distribute tokenized crypto securities in a regulatory compliant manner in accordance with the Electronic Securities Act (eWpG).

Solutions

Our solutions for Financial institutions & Wealth managers

Financial institutions

Stay future-proof by digitizing securities issuance and settlement. Cashlink offers the leading banking grade tokenization infrastructure. Learn more about our solution for financial institutions.

Wealth managers

Cashlink provides wealth managers with easy access to alternative asset classes. Take advantage of the enormous potential of alternative assets for sustainable positioning and create competitive advantages.

"Cashlink's unique infrastructure is a substantial building block that enables our "Tokenization as a Service". In particular, the holistic infrastructure solution with its combination of technology and regulatory capabilities is a great fit for our full-service offering around asset tokenization."

Talk to our experts

Our team will be happy to advise you, arrange a non-binding consultation now.

Simon Censkowsky

Senior Manager Strategic Business Development

s.censkowsky@cashlink.de

linkedin.com/in/scenskowsky