Token-based bonds

Token-based bonds: Digital. Efficient. Transparent.

Issue bonds faster, more efficiently and more cost-effectively than ever before. With Cashlink you benefit from a regulatory compliant solution - shorter settlement times, automated processes and maximum transparency. The perfect financing solution for treasury and project financing.

Instant issuance & settlement: Issuance & settlement times are significantly reduced from days to minutes

Automation through smart contracts: Reduces manual processes & administrative effort.

Compatible with all forms of money: Cashlink bonds can be settled with central bank money, stablecoins and FIAT money.

Token-based bonds: A new standard for the capital market

The financial sector is changing – new technologies such as blockchain and smart contracts are revolutionizing the issuance and settlement of bonds. While traditional processes are usually complex and time-consuming, token-based bonds enable faster, more transparent and more efficient processing.

With the Electronic Securities Act (eWpG), Germany has created the regulatory basis for issuing digital securities in a legally secure manner. Nevertheless, the market is still in its infancy. International financial centers such as the USA and Asia are also driving development forward. Germany currently has a significant regulatory competitive advantage. Now is the right time to benefit from the advantages of tokenized bonds and develop tailor-made (re-)financing options.

Take the next step into the digital future of the capital market. Talk to our experts and let us advise you without obligation!

Token-based vs. traditional bonds: The direct comparison.

Token-based bonds

- Faster settlement:

Settlement takes place within T+1 or even in real time.

- Automated processes:

Smart contracts handle issuance, coupon payments and repayments.

- Compatible with digital money:

With digital bonds, your business remains future-proof — whether with central bank money or stablecoins.

- Easier market access:

Issuances are processed efficiently and globally via digital platforms or broker connections.

Classic, securitized bond

- Slow settlement:

Classic bonds have a settlement time of T+2 or longer.

- High administrative expenses:

Many processes require manual coordination and several intermediaries.

- Limited traceability:

Ownership structures and transactions are often not visible in real time.

- Limited compatibility with digital money:

Settlement with DLT-based money is hardly possible because the asset is not on the blockchain.

usecase

First blockchain-based KfW bond - with Cashlink as crypto securities registrar & DLT market operator

KfW issues token-based bonds with Cashlink on the blockchain.

Together with Cashlink, KfW issued two bond issuances in 2024 (total volume EUR 150 million) as crypto securities in token-based form. Cashlink and KfW also took part in the ECB trials. In this context, cash settlement was carried out using a form of digital central bank money based entirely on DLT. By linking money and assets on the blockchain, settlement risks could be reduced and efficiencies increased. For example, settlement times of just a few minutes were achieved in the delivery vs payment process. As the central infrastructure service provider for the crypto securities registry and market DLT operator, Cashlink provided the technical solution for the digital issuance and enabled efficient, transparent and automated settlement.

The project shows how token-based bonds shorten settlement times, optimize processes and increase transparency in the capital market – an important step towards the future of digital financing.

Learn more about the implementation of token-based bonds with Cashlink.

Press

Token-based bonds in the press

Solutions

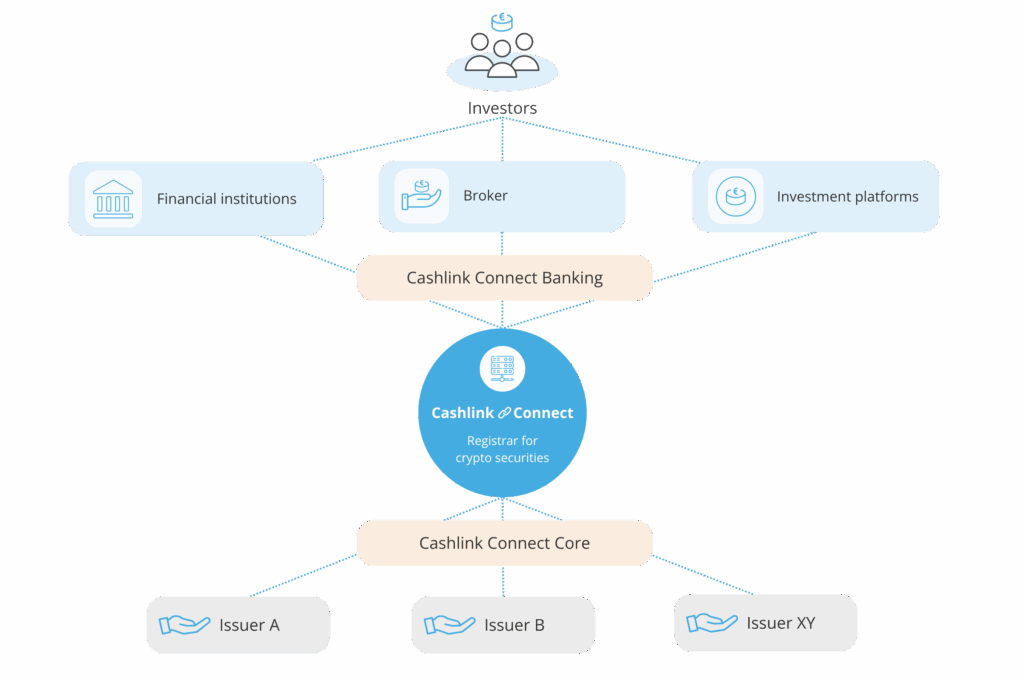

How Cashlink enables token-based Capital Markets

Cashlink provides a modular solution along the issuance- and post trade valuechain of token-based securities. As a regulated financial institution after the German Banking Act (KWG), Cashlink holds a license as a crypto securities registrar and qualifed crypto custodian.

Cashlink Connect Core

The issuance module enables issuers to issue regulatory–eWpG-compliant, token-based securities on the blockchain — with a proven and multiple times audited smart contract suite. Cashlink’s robust and scalable API based infrastructure, connects issuers with brokers and trading venues and is interoperable with stablecoins and upcoming ECB Digital Money solutions.

Cashlink Connect Banking

The settlement module enables custodian banks, brokers and exchanges to seamlessly settle token-based securities post-trade in full regulatory compliance in collective entry. Get access to all token-based securities registered by Cashlink and ensure secure, efficient, and transparent settlement on the blockchain without added complexity.

FAQ

Frequently Asked Questions about Token-based Bonds

What differentiates a token-based bond from traditional bond structures?

A token-based bond is an electronic security issued and managed using blockchain technology. In contrast to traditional bonds, no central securities depository (CSD) is required. The securities register is maintained digitally in a crypto securities register in accordance with the German Electronic Securities Act (eWpG).

What operational advantages do token-based bonds offer issuers?

- Faster settlement: Settlement takes place within T+1 or even in real time (T+0).

- Automated lifecycle events such as coupon and redemption payments via smart contracts.

- Flexible payment options inducing FIAT, stablecoins and digital central bank currency.

- Broader digital placement options through multiple distribution channels globally.

These benefits arise from a fully digitalized issuance process and the elimination of traditional intermediaries.

Are token-based bonds compliant with regulations?

Yes. Token-based bonds are issued within the legal framework of the German eWpG. Cashlink is a BaFin-regulated financial institution authorized to act as a crypto securities registrar and crypto custodian.

How does the technical process of issuance & settlement work?

Issuance is conducted via Cashlink Connect Core, a modular API-based infrastructure using smart contracts to map the entire lifecycle of a bond. Settlement is performed through Connect Banking, which enables efficient processing of digital bonds held in omnibus accounts at custodian banks or DLT-based trading venues.

Are there real-world use cases?

Yes. A prominent example is KfW, which has issued token-based bonds multiple times with Cashlink. Settlement times were reduced to just a few minutes by combining cash and securities on the blockchain.

Talk to our team of experts

Our team will be happy to advise you. Arrange a non-binding consultation now.

Simon Censkowsky

Head of Business Development

s.censkowsky@cashlink.de

linkedin.com/in/scenskowsky