Trailblazing Securities

Cashlink provides the eWpG-compliant infrastructure for tokenized securities.

BENEFITS

Advantages of tokenized securities under eWpG

Cost savings of up to 80%

Thanks to an increase in process efficiency and the elimination of intermediaries, costs can be reduced by up to 80%. Read more in our pricing study.

Easier access to private market assets

Thanks to fractionalization, tokenization enables investments with small volumes and increases fungibility.

Fully regulated

The Electronic Securities Act (eWpG) provides a clear legal framework for tokenized securities.

Competitive advantage through future-proof infrastructure

Tokenization and distributed ledger technology enable innovative business models and fully digital processing.

Services

Our services as a crypto securities registrar

Issuer services

We offer issuers eWpG-compliant register management services for bearer bonds, crypto fund units and registered shares.

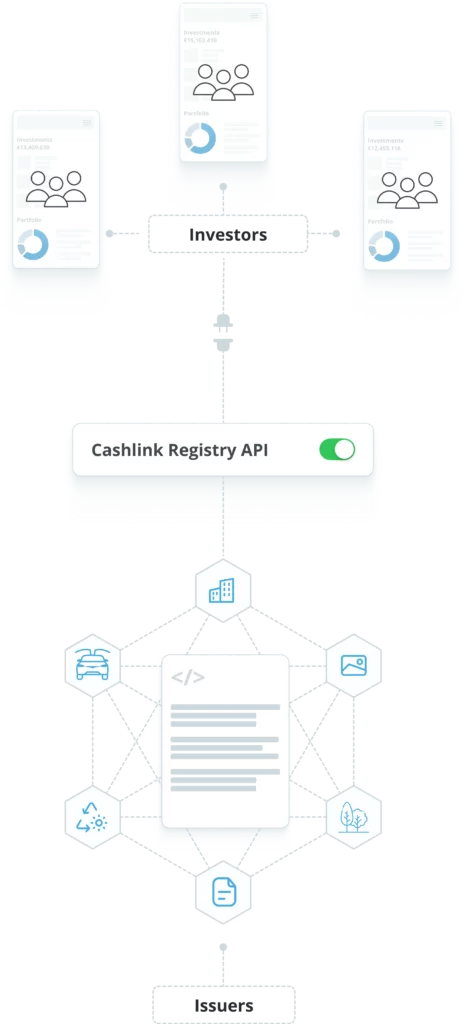

Financial institutions

Connect to Cashlink's Crypto Securities Registry to act as a transaction agent for your own or third-party issuances.

Digital investment platforms

Use Cashlink´s infrastructure to issue securities for your clients and distribute them via your platform.

Distribution platforms & Custodian banks

Offer tokenized securities to your end investor target group by simply connecting to our system for securities settlement.

Features

Our technical infrastructure

API first

Our robust infrastructure, based on the latest API standards, enables simple integration and scaling of your project.

EVM-compatible multi-chain compatibility

Our audited EVM Smart Contracts implement all the requirements of the eWpG and take over on-chain tasks (e.g. gas tank).

Interoperability

Thanks to our token standard and our technical infrastructure, we are compatible with other market participants.

On-Chain Compliance

Our technical infrastructure automatically implements compliance requirements on-chain.

"Cashlink's unique infrastructure is a substantial building block that enables our "Tokenization as a Service". In particular, the holistic infrastructure solution with its combination of technology and regulatory capabilities is a great fit for our full-service offering around asset tokenization."

Get started with crypto securities now.

Integrate the eWpG-compliant infrastructure for tokenized securities and get started with Cashlink as a crypto securities registrar.