Tokenization Study

Cost savings potential of DLT based capital market infrastructures

A quantitative analysis.

Study

22-85% potential cost savings

Experts from FinPlanet, Cashlink and Porsche Consulting have conducted a comprehensive study to analyze the potential cost savings that can be realized through the use of DLT in the capital market. To this end, the costs of a conventionally issued bearer bond were compared with a crypto security as defined by the eWpG along the entire value chain of a capital market transaction.

The study shows that the use of distributed ledger technology (DLT) in the capital market enables significant cost savings.

The authors of the study chose an independent “bottom-up” approach in order to be able to draw conclusions about the cost items from the processes involved in a capital market transaction. To evaluate the costs, capital market experts and market participants were interviewed and price and service specifications were analyzed. The study comes to the conclusion that a DLT-based capital market infrastructure can realize cost savings potential of up to 85% in the middle and back office processes by 2028 compared to the existing capital market infrastructure. Even today, there is already potential for cost savings of up to 22%, depending on the underlying assumptions.

The study also shows that the savings potential lies mainly in the middle and back office processes. In particular in the Corporate Actions & Asset Servicing and Clearing & Settlement processes.

If you have any questions about the study, you can submit them here via ChatGPT (Requires ChatGPT Plus) or contact us directly.

Free Download

Solutions

How Cashlink enables token-based Capital Markets

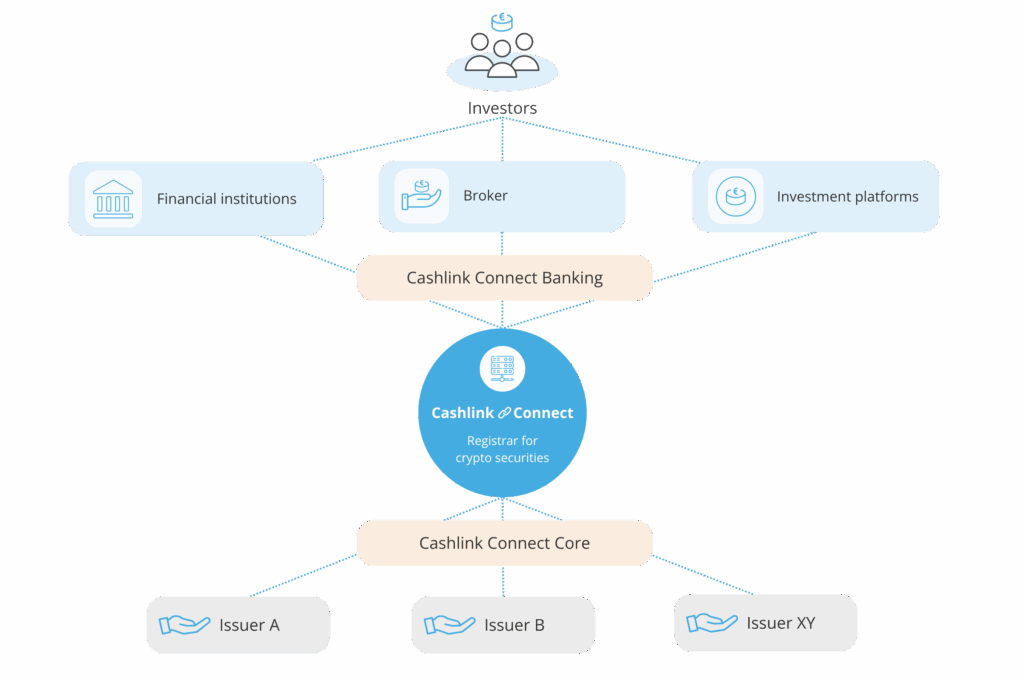

Cashlink provides a modular solution along the issuance- and post trade valuechain of token-based securities. As a regulated financial institution after the German Banking Act (KWG), Cashlink holds a license as a crypto securities registrar and qualifed crypto custodian.

Cashlink Connect Core

The issuance module enables issuers to issue regulatory–eWpG-compliant, token-based securities on the blockchain — with a proven and multiple times audited smart contract suite. Cashlink’s robust and scalable API based infrastructure, connects issuers with brokers and trading venues and is interoperable with stablecoins and upcoming ECB Digital Money solutions.

Cashlink Connect Banking

The settlement module enables custodian banks, brokers and exchanges to seamlessly settle token-based securities post-trade in full regulatory compliance in collective entry. Get access to all token-based securities registered by Cashlink and ensure secure, efficient, and transparent settlement on the blockchain without added complexity.

Talk to our experts

Our team will be happy to advise you, arrange a non-binding consultation now.

Simon Censkowsky

Head of Business Development

s.censkowsky@cashlink.de

linkedin.com/in/scenskowsky